Irs Estimated Tax Form 2025 - It’s important to note that taxpayers anticipating a sizable capital gain on the sale of an investment during the year may also need to make a quarterly estimated tax payment. Enter your filing status, income, deductions and credits and we will estimate your total taxes. IRS Form W2 LinebyLine Instructions 2025 Understanding Your Form W, Penalties may apply if the corporation does not make required estimated tax payment deposits. Use this secure service to pay your taxes for form 1040 series, estimated taxes or other associated forms directly from your checking or savings account at no cost to you.

It’s important to note that taxpayers anticipating a sizable capital gain on the sale of an investment during the year may also need to make a quarterly estimated tax payment. Enter your filing status, income, deductions and credits and we will estimate your total taxes.

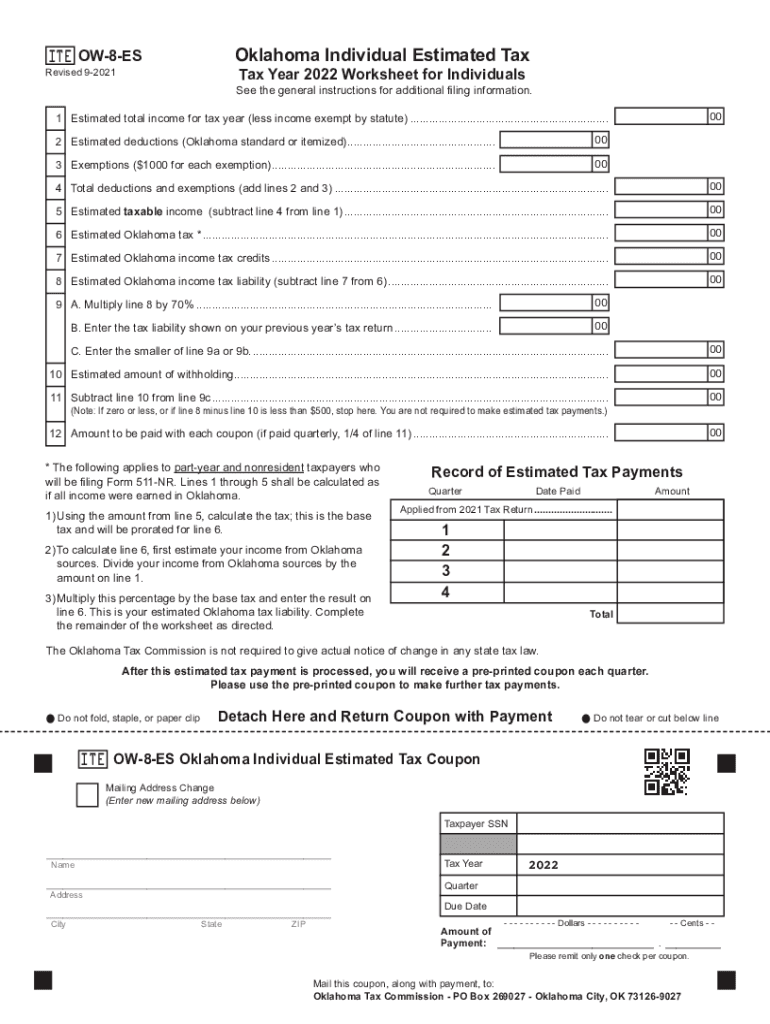

Federal Estimated Tax Forms 2025 Melli Siouxie, Use this secure service to pay your taxes for form 1040 series, estimated taxes or other associated forms directly from your checking or savings account at no cost to you. Quarterly estimated tax payments for the 2025 tax year will be due:

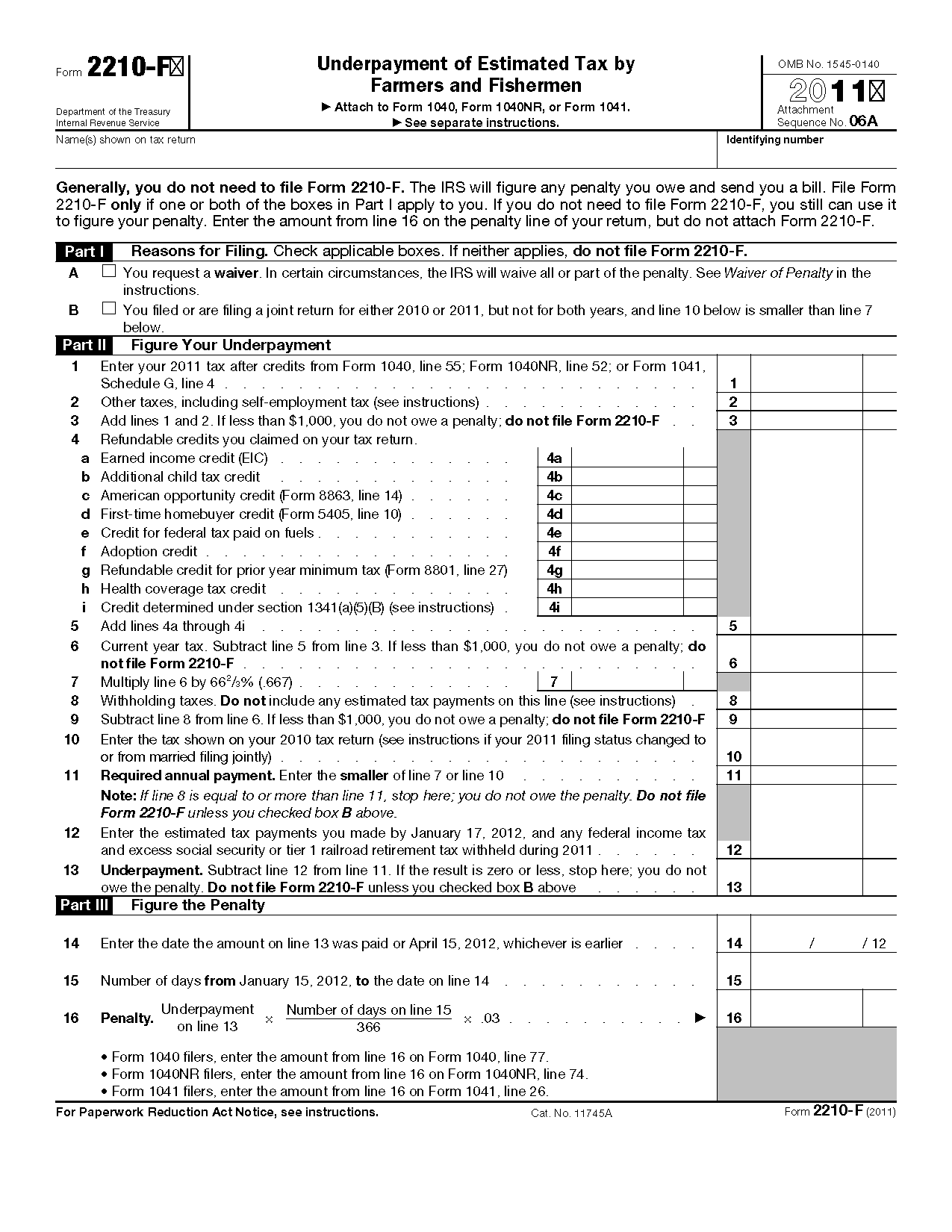

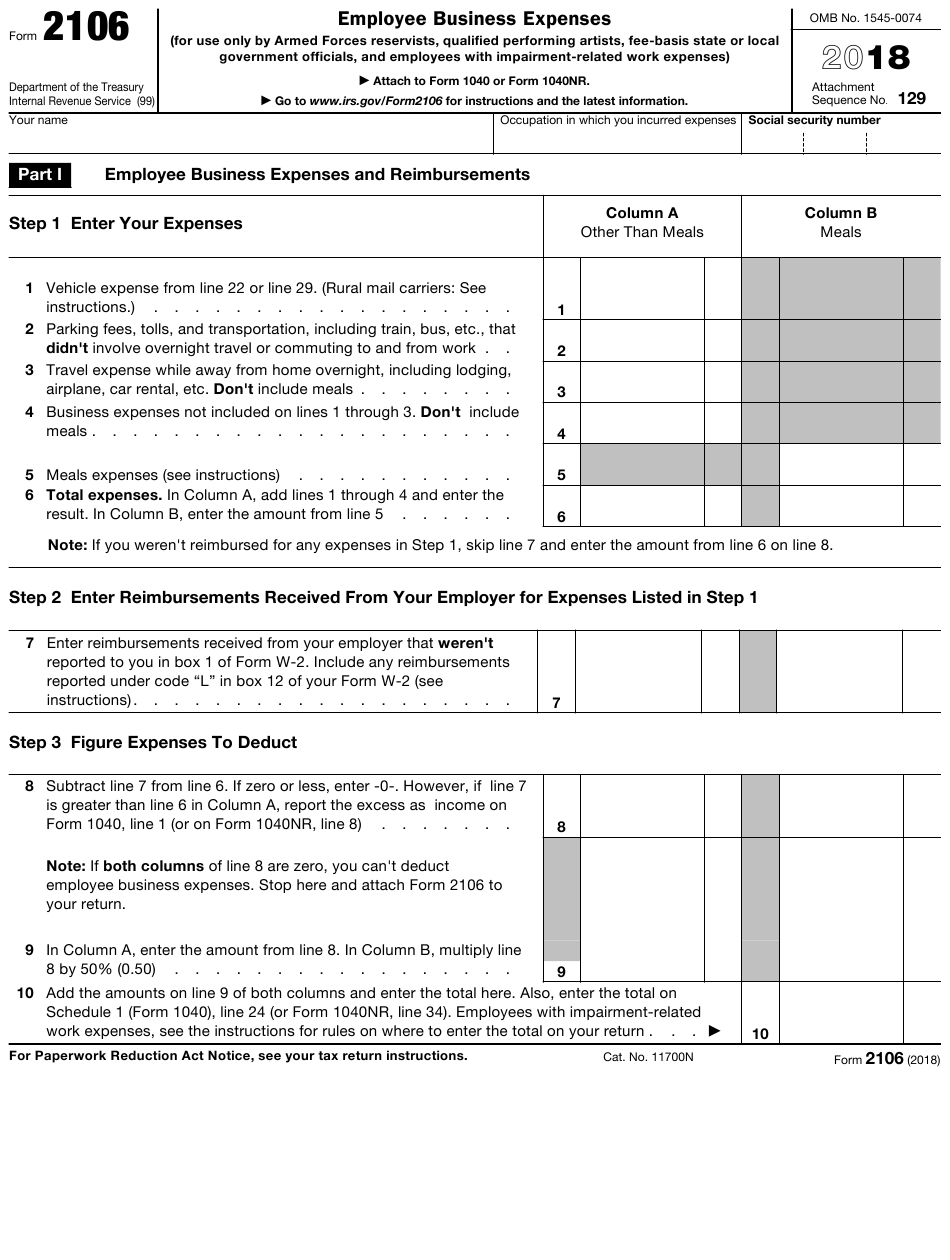

Irs Form 2290 Printable, How to use the irs estimated tax worksheet to calculate your tax bill throughout the year Estimated tax payments are the taxes you pay to the irs throughout the year to account for income you've earned that wasn't subject to tax withholding.

Estimated Tax Payments 2025 Form Berna Cecilia, Avoid a penalty by filing and paying your tax by the due date, even if you can’t pay what you owe. Direct pay with bank account.

Irs 2025 Tax Calculator Estimate Mair Jobina, Possessions, or with other international filing characteristics). Use your 2025 federal tax return as a guide.

Use the estimated taxable income to calculate your tax liability for the year.

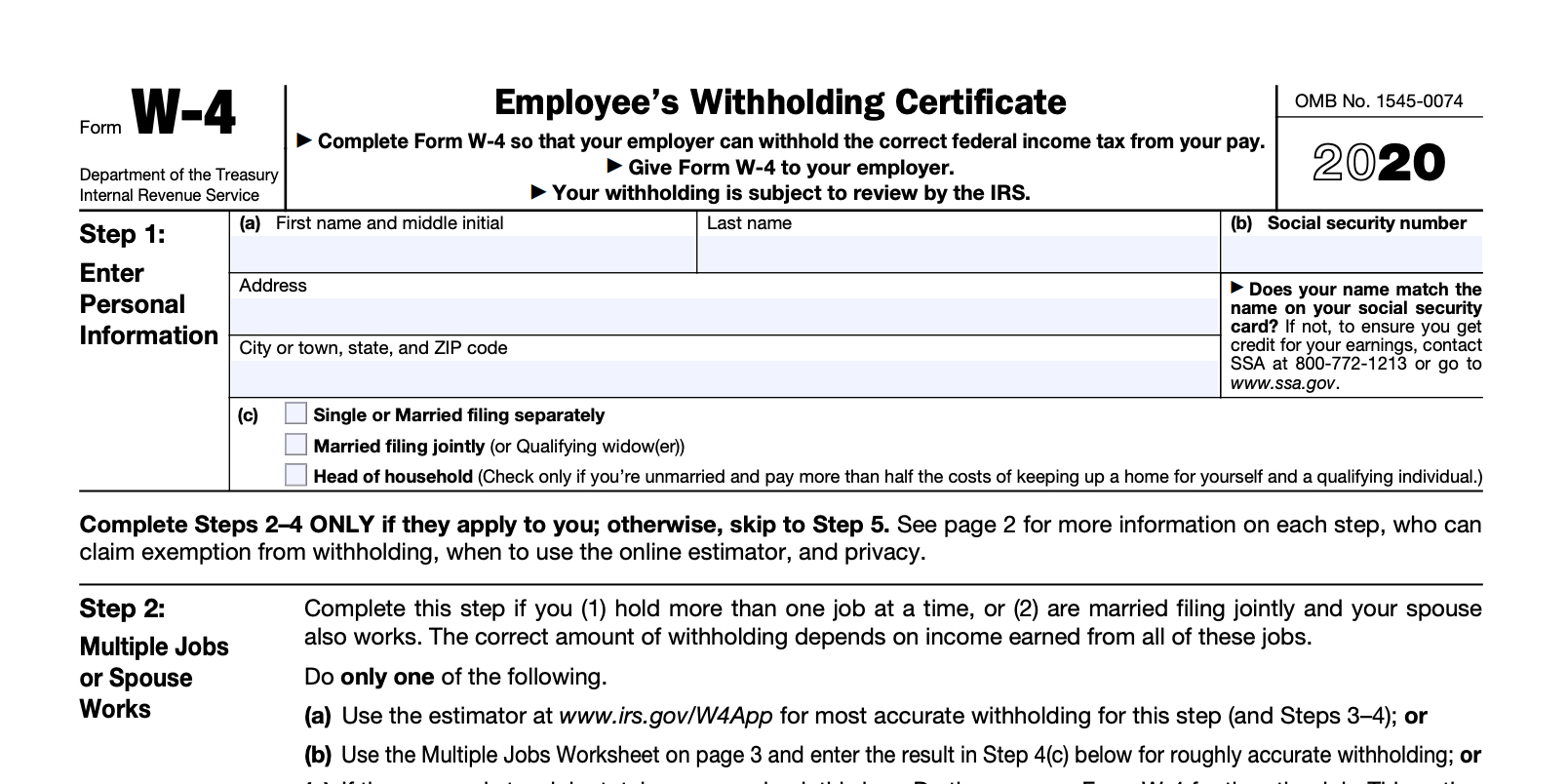

New Employee Irs Forms 2025, Estimated tax payments are the taxes you pay to the irs throughout the year to account for income you've earned that wasn't subject to tax withholding. Enter your filing status, income, deductions and credits and we will estimate your total taxes.

When figuring your 2025 estimated tax, it may be helpful to use your income, deductions, and credits for 2025 as a starting point. It’s important to note that taxpayers anticipating a sizable capital gain on the sale of an investment during the year may also need to make a quarterly estimated tax payment.

Irs W 4 2025 Form Lanny Modesty, Need more time to pay? The first line of the address should be internal revenue service center.

Estimated tax payments are the taxes you pay to the irs throughout the year to account for income you’ve earned that wasn’t subject to tax withholding.

Form 129 maryland Fill out & sign online DocHub, How to make estimated tax payments and due dates in 2025. The irs has set four due dates for estimated tax payments in 2025:

20182025 Form MD 502D Fill Online, Printable, Fillable, Blank pdfFiller, The irs has set four due dates for estimated tax payments in 2025: When figuring your 2025 estimated tax, it may be helpful to use your income, deductions, and credits for 2025 as a starting point.

W4 Form 2025 Instructions In Pavla Beverley, If your name, address, or ssn is incorrect, see instructions. Alternatives to mailing your estimated tax payments to the irs;

By the end, you’ll feel more equipped to navigate estimated taxes and avoid potential tax surprises in 2025.